Routine vs. Medical Insurance: Explained

In ophthalmology and optometry, there are two types of insurance coverage: routine vision insurance and medical insurance.

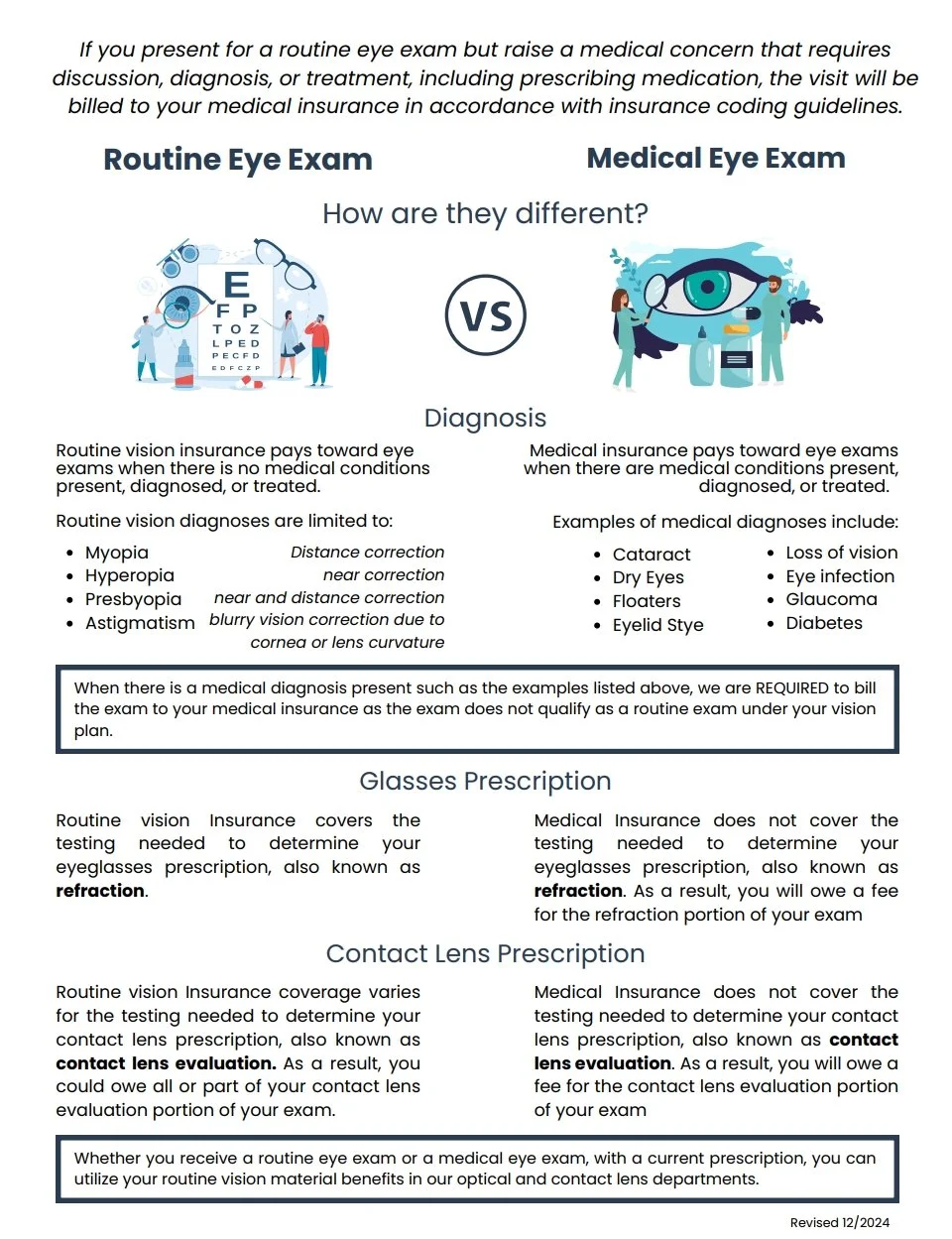

Routine vision insurance is designed to cover routine eye exams and corrective eyewear such as eyeglasses and contact lenses. Routine vision insurance does not cover medical conditions or treatments related to the eyes, such as dry eyes, cataracts, glaucoma, diabetes, or macular degeneration.

Medical insurance, on the other hand, covers medical conditions listed above and visits related to the eyes, such as eye infections, injuries, and surgeries. Medical insurance does not cover elements of the exam deemed as “routine” such as the refraction and contact lens evaluation. If you have a medical exam and receive a refraction and/or contact lens evaluation, these services are not covered by your medical plan and will incur additional fees.

The difference between routine vision insurance and medical insurance can be confusing, but it is beneficial to understand because it can affect the cost of your eye care services. Our office can help you determine which of your insurances needs to be filed based on the reason for and results of your visit.

In summary, routine vision insurance covers routine eye exams and corrective eyewear, while medical insurance covers medical conditions and treatments related to the eyes. It is important to understand what type of insurance you have and what services are covered under your plan to avoid unexpected costs.